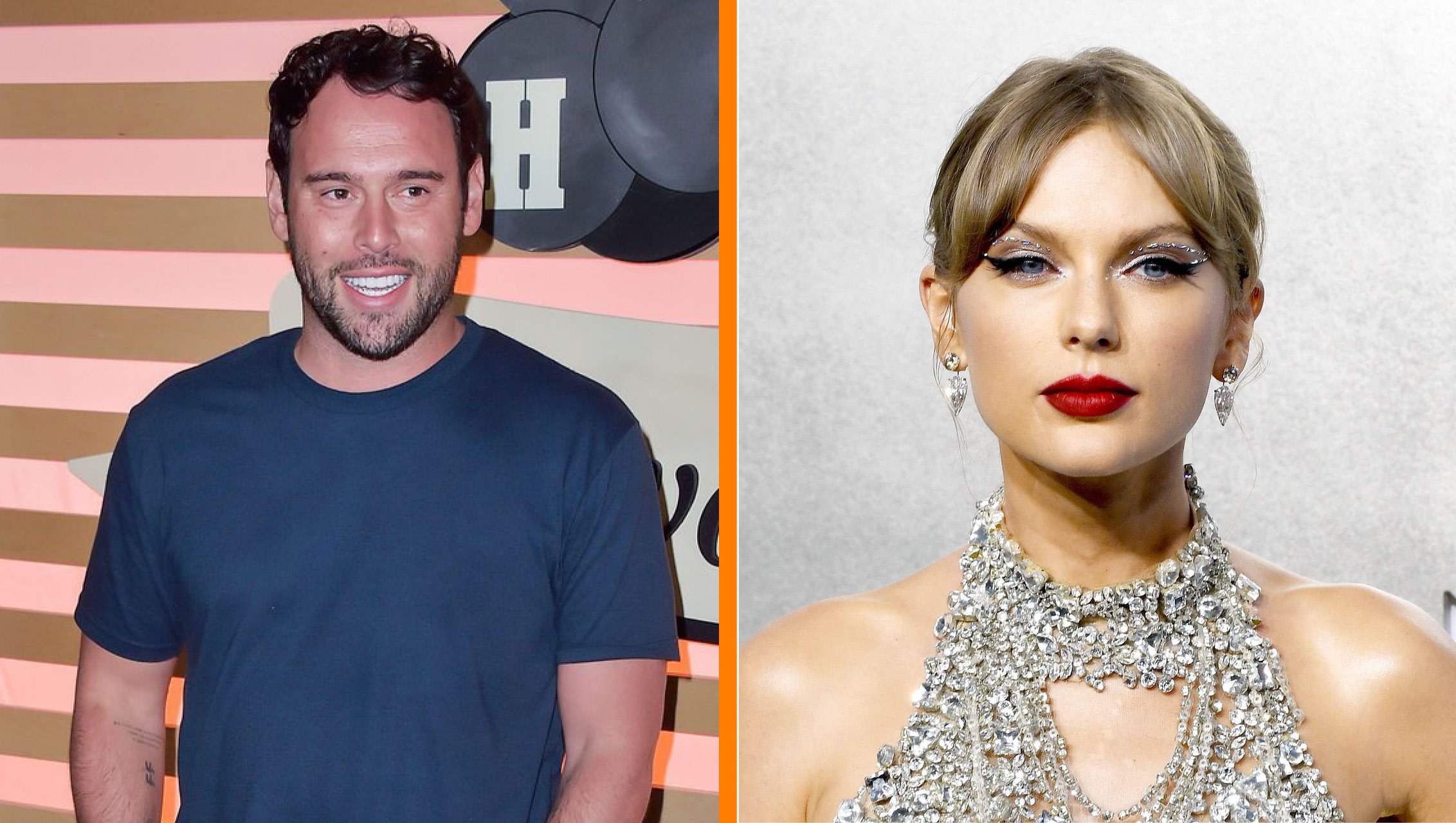

Find Out How Scooter Braun Tried to Sell Taylor Swift Her Masters – The Outcome Will Shock You!

Taylor Swift’s tumultuous journey with her ‘Big Machine’ masters has been a whirlwind of controversy and intrigue, and Music Business Worldwide recently delved deep into the intricacies of the saga. From the initial sale to Scooter Braun’s Ithaca Holdings in 2019 to the subsequent acquisition by US-based financial firm Shamrock Capital in 2020, the story is rife with unexpected twists and turns.

In a detailed investigation spanning 4,000 words, Music Business Worldwide uncovered some shocking revelations that shed light on the intricacies of the deals. One of the most significant findings was that Scott Swift, Taylor Swift’s father and a Merrill Lynch stockbroker, received a substantial $15.1 million payout from the sale of Big Machine Label Group to Scooter Braun’s Ithaca Holdings in 2019 due to his stake in Big Machine Records LLC.

Furthermore, it was revealed that Scooter Braun likely ascended to billionaire status, profiting a staggering $265 million from the purchase and subsequent sale of Taylor Swift’s first six albums. Initially, Braun’s team valued Swift’s catalog at $140 million when acquiring Big Machine Label Group, only to sell it to Shamrock for a total of $405 million in the following year.

However, the most intriguing aspect of MBW’s report centered around an NDA (non-disclosure agreement) signed between Jay Schaudies from Swift’s management firm, 13 Management, and Scooter Braun’s Ithaca Holdings in November 2019. This agreement granted Swift’s team access to Big Machine’s financials, fueling speculation that Swift was aiming to repurchase her masters from Braun.

In a surprising turn of events, it was revealed that Scooter Braun had expressed willingness to sell back Swift her ‘Big Machine’ masters in a May 2020 email from Jay Schaudies to Braun. Despite this apparent openness to negotiations, the deal eventually fell through, leading to Shamrock Capital’s eventual acquisition of Swift’s masters.

A contentious point in the negotiations revolved around the terms of a new NDA proposed in June 2020, which allegedly imposed restrictions on Swift’s ability to speak freely about Braun and Ithaca Holdings. This clause, however, appeared to only limit disclosures related to deal negotiations rather than stifling Swift’s public commentary on individuals involved.

Despite the failure to reach an agreement, it was reported that multiple offers were made for Swift to repurchase her masters from Braun, with the highest bid being $305 million in October 2020. Swift’s decision to refuse these offers was met with mixed reactions, with conflicting narratives emerging regarding the presence of a “gag order” in the proposed NDAs.

In light of these revelations, Taylor Swift has chosen to focus on her musical endeavors, recently announcing a record-breaking Eras tour scheduled for 2024. With a staggering net worth of $740 million and a string of successful albums under her belt, Swift’s resilience and creativity continue to captivate audiences worldwide.

As the music industry grapples with the complexities of ownership and artistic rights, Taylor Swift’s story stands as a compelling narrative of empowerment and perseverance in the face of adversity. Stay tuned for more updates on this evolving saga from Music Business Worldwide.