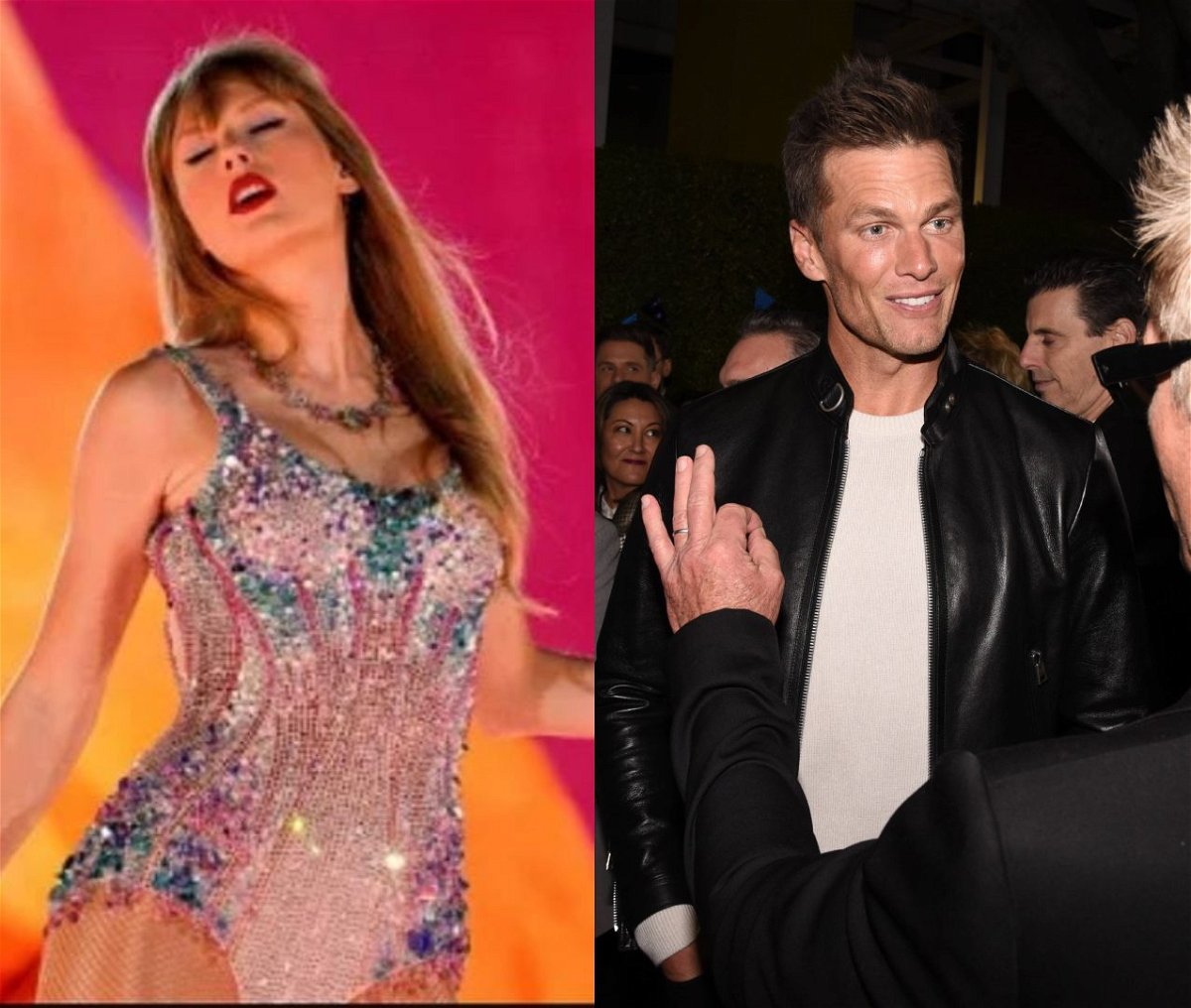

Taylor Swift narrowly avoids being involved in $32 billion Ftx scandal, while Tom Brady takes the fall

FTX, a bankrupt cryptocurrency company, is currently entangled in an ongoing class-action lawsuit that also targets several celebrities who endorsed the brand. Notable personalities involved in this legal battle include sports and sports media figures, such as former NFL quarterback Tom Brady and his wife Gisele Bundchen. The couple reportedly faced substantial financial losses due to their association with FTX.

Interestingly, one famous pop singer managed to steer clear of this financial disaster. Taylor Swift, it seems, dodged a bullet when it comes to FTX. According to reports, Swift, like many other celebrities, was initially interested in investing with FTX but did not proceed due to the delays caused by Sam Bankman-Fried, the founder of the company. It was revealed in the latest book by author Michael Lewis, titled “Going Infinite,” that Swift had a potential agreement with FTX that could have earned her between $25 and $30 million annually. However, Bankman-Fried’s hesitancy in finalizing the deal led to its collapse.

Michael Lewis detailed in his book a conversation he had with a former FTX employee, Natalie Tien, who disclosed that Taylor Swift had expressed interest in the deal but was met with delays from Bankman-Fried’s side. Another individual involved in the negotiations confirmed this information.

The negotiations between Swift and FTX eventually centered on the cryptocurrency company becoming the exclusive payment partner for Taylor Swift’s tour. However, the deal fell through as FTX lost interest due to the primary focus being on sponsorship for the tour rather than a broader endorsement deal.

While Taylor Swift managed to evade the cryptocurrency market turmoil, many other celebrities and sports figures were not as fortunate. For example, Tom Brady and Gisele Bundchen faced significant losses amounting to millions of dollars due to FTX’s bankruptcy. Even high-profile individuals like BlackRock CEO Larry Fink suffered substantial financial setbacks during this crypto frenzy, underscoring the risks and volatility inherent in the cryptocurrency market.

The ongoing criminal trial against Sam Bankman-Fried has raised serious allegations concerning his actions at FTX. Accusations range from defrauding individuals and financial institutions of billions of dollars to engaging in risky trades at his cryptocurrency hedge fund, ‘Alameda Research.’ Bankman-Fried is also alleged to have misappropriated customer funds for personal gain, including purchasing real estate and making political contributions that could potentially influence government regulations in the cryptocurrency sector.

As the trial unfolds, the legal proceedings will determine Bankman-Fried’s culpability in these charges and what implications they may have for the cryptocurrency industry as a whole. Stay tuned for updates on this developing story.